산업동향

Weak investment in the healthcare system

- 등록일2015-05-21

- 조회수3998

- 분류산업동향 > 제품 > 바이오의약

-

자료발간일

2015-03-30

-

출처

Deutsche Bank Research

- 원문링크

-

키워드

#healthcare

- 첨부파일

Weak investment in the healthcare system

March 30, 2015

Since around 2009, the German healthcare system has been characterised by weak investment. One reason is that public subsidies for the sector have been reduced. This development harbours risks, for only a regular renewal of medical appliances and equipment is likely to ensure the high quality of treatment in Germany in the long term. By contrast, lower investments in the building stock would primarily mean a reduction in the current hospital overcapacities.

Decline in investment from 2009

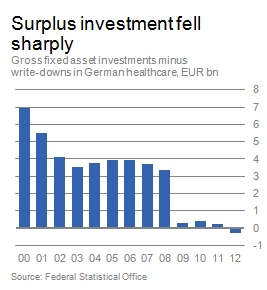

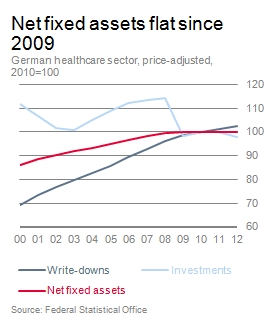

Within the public services, education and health sector, the healthcare segment has been characterised by two distinct phases of development. While between 2000 and 2008 gross fixed capital formation was consistently much higher than write-downs, this difference narrowed perceptibly from the recession year 2009. In 2012 write-downs even exceeded capital spending. In sum, net fixed assets barely more than stagnated from 2009 to 2012, while they rose by 2.5% in services sectors as a whole. In the end, healthcare lived on its reserves during this period.

The longer-term development of healthcare has shown that net fixed assets in plant and equipment have risen much more quickly than net fixed assets in the area of buildings (2000 to 2012: 39% vs 10%). However, from 2009 to 2012, growth in both asset groups almost came to a standstill (2009 to 2012: -0.7% and +0.4%). This was probably mainly due to the dependence of capital spending of healthcare on public and especially municipal subsidies. These declined in the wake of the economic and financial crisis.

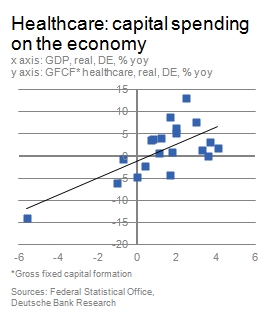

Advances in medical technology as well as the possibilities of invoicing new treatment methods may well have been the major drivers for the initially quicker growth of net fixed assets in the area of plant and equipment. However, as medical appliances and other equipment are publicly subsidised as well, absolute gross fixed capital formation declined strongly since 2008 (2012 vs 2008: 18.1%). In addition, regulatory uncertainties in healthcare are likely to have impeded substantial investment in new plant. Finally, this reflects an interesting phenomenon in healthcare: while the investment carried out relatively strongly depends on the state of the economy, total capital spending on health in Germany (including spending of private households) has been rising relatively steadily for years.

The low investment activity of the last few years harbours risks for the future development of healthcare. Only a regular renewal of medical appliances and equipment is likely to secure the high quality of treatment in Germany in the long term. Furthermore, in the event of declining investment, there is a risk that new treatment methods cannot be used; technical progress in the sector would be slowed.

The risks outlined above mainly refer to investment in the area of plant and equipment. In contrast, a decline in net fixed assets in the building stock portfolio would primarily reduce the current hospital overcapacities. Such a capacity reduction is in line with the targets of the key issues paper on hospital reform, which a joint federal-Lander working group under the leadership of the Federal Ministry of Health had presented at the end of 2014. The paper could trigger an improvement in investment activity at the hospital level.

Public subsidies: a bottleneck

Many public operators of healthcare institutions cannot make sufficiently high investments due to their tight financial situation. By contrast, privately operated institutions are better placed in terms of their own financing possibilities in many cases. One main reason for this is probably the fact that average personnel and material expenses in private hospitals are lower than in public institutions. The quicker reduction in hospital capacity intended by politicians could lead to an improvement of the financial situation of the remaining institutions. The investment funds available would be spread across a smaller number of hospitals; this would also facilitate greater specialisation by individual hospitals. Thus, gross fixed assets could be higher than write-downs in healthcare in the long term. Further efficiency measures, e.g. inter-municipal purchasing alliances for public health institutions, would also increase the scope for investments. However, according to the most recent surveys, only roughly 30% of public hospitals are considered to be able to invest without public subsidies. At the regional level, further closures of hospitals are therefore likely for economic reasons; between 2000 and 2012, the number of hospitals already fell by around 250 (11%).

Currently, healthcare facilities in Germany are still in a relatively good state. As the healthcare sector in Germany ? not least as a result of demographic developments ? remains a growth market all in all and increasing numbers of cases are foreseeable, investment activity in the sector must be raised in the long term to ensure that the usual and desired quality standards are maintained. This requires both targeted state commitment and fundamental process optimisation, as well as a of strategy in the sector.

For further information on the subject of investment at sectoral level please see: Heymann, Eric (2014) Investment activity in Germany at sectoral level. Deutsche Bank Research.

Publication of the German original: March 17, 2015

[KiET 해외산업정보 요약 분석 참고]▼

독일 헬스케어 산업에서의 투자 현황 향후 전망

■ 주요 내용

- 2009년 이후로 독일의 헬스케어 산업은 투자 부족으로 어려움을 겪고 있는데, 가장 큰 이유는 이 산업 영역에 대한 정부의 지원이 감소하였기 때문임.

- 이로 인해 현재 병원들이 과도하게 보유하고 있는 생산 역량이 점차 줄어들 것으로 전망됨.

- 하지만 향후 헬스케어 산업의 수익성을 높이고 혁신을 달성하기 위해서는 투자가 기본이 되어야 할 것임.

- 독일 내의 다른 경제 산업 영역에서는 지난 몇 년 동안 상당히 활발한 투자 활동이 이루어졌음.

- 에를 들어 2000년에서 2012년 사이에 제조업에서의 고정 자산은 1.4%가 감소한 반면, 서비스 산업은 좀 더 투자 친화적인 모습을 보여준 덕분에 같은 시기 동안 순수치의 고정 자산 비중이 13.8%가 상승하였음.

- 특히 비즈니스 서비스 제공업 기업들은 37.9%의 투자 증가를 기록하였고, 교통 및 창고업 역시 32.1%의 투자 증가가 기록되었음.

- 공공 서비스 산업과 교육 및 헬스케어 산업 내에서 헬스케어 세부 분야는 발전 단계에 따라 두 단계로 나누어 살펴볼 수 있는데, 2000년에서 2008년 사이에 총고정자본 형성은 계속해서 감각상각을 상회하였는데, 그 차이는 2009년 글로벌 경기 침체 이후로 점차 좁혀지기 시작하였음.

- 2012년의 경우 감가상각 규모는 심지어 자본 지출보다 커지는 결과를 낳았음.

- 반면 서비스업에서의 그 수치가 2.5%가 상승한 것으로 나타났음.

- 헬스케어 산업의 장기 발전 측면에서 공장이나 장비 등과 같은 고정 자산은 건물 등과 같은 고정 자산의 증가에 비해서 훨씬 빠른 것으로 나타났음.

- 많은 공공 헬스케어 관련 기관들은 어려워진 재정 상황으로 인해 충분한 투자를 수행하지 못하는 반면, 민간 기업들은 많은 경우 자금 사정이 조금 나은 것으로 나타났음.

☞ 자세한 내용은 내용바로가기 또는 첨부파일을 이용하시기 바랍니다.

지식

동향

- 기술동향 Big data of medical imaging for customized smart healthcare 2016-05-17

- 정책동향 유-헬스케어(u-healthcare)의 현황 및 과제 2014-10-10

- 정책동향 Stimuli to innovation in the healthcare industry : Effects on healthcare costs, competitiveness and employment 2012-11-14

- 기술동향 Robotics for healthcare Final Report 2009-01-20

- 정책동향 Biomaterials for healthcare – A decade of EU-funded research 2007-09-12

Weak_investment_in_the_healthcare_system.pdf

Weak_investment_in_the_healthcare_system.pdf